Tax Setup |

|

|

|

|

Tax Setup |

|

|

|

![]()

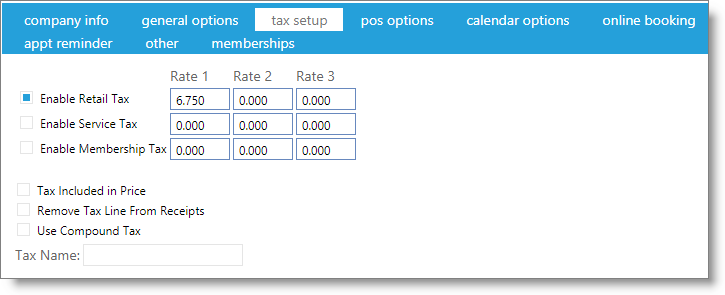

Setup Company Sales Tax Rates

Check the "Enable" box for all item types listed that you must charge sales tax. Then enter the sales tax percentage rate under "Tax Rate 1". If your business charges an additional sales tax that you must keep separate records for, enter it under "Tax Rate 2" and "Tax Rate 3". Each tax rate will show separately on your sales tax reports.

Tax Included in Price

Check this box if your prices include the tax amount.

Remove Tax Line From Receipt

Check this box if you do not want to display the amount of tax that the client is being charged on their printed or emailed receipt.

Use Compound Tax

Check this box if you wish to use the tax percentage that you have set in the "Tax Rate 2" field to tax the entire total, including the tax that has already been calculated with the percentage that you have entered in the "Tax Rate 1" field.

Selecting to Use Compound Tax with rates 1, 2 and 3 will use the tax percentage that you have set in the "Tax Rate 3" field to tax the entire total, including the tax that has already been calculated with the percentages that you have entered in the "Tax Rate 1" and "Tax Rate 2" fields.

Tax Name

Enter the name that you would like used to replace the word "Tax". The new word entered here will replace the word "Tax" throughout the program. It will also change the name of the Sales Tax Summary Report.